Why Conversational AI in Banking is the Future: A CXO’s Guide

Why Conversational AI in Banking is the Future: A CXO’s Guide

AI in banking: The Covid-19 epidemic has increased the tendency of people using a smartphone app instead of visiting their local branch. Market research firm Juniper Research estimates that in 2026, around 3.6 billion bank customers worldwide will prefer to communicate with their providers digitally, up from 2.4 billion in 2020.

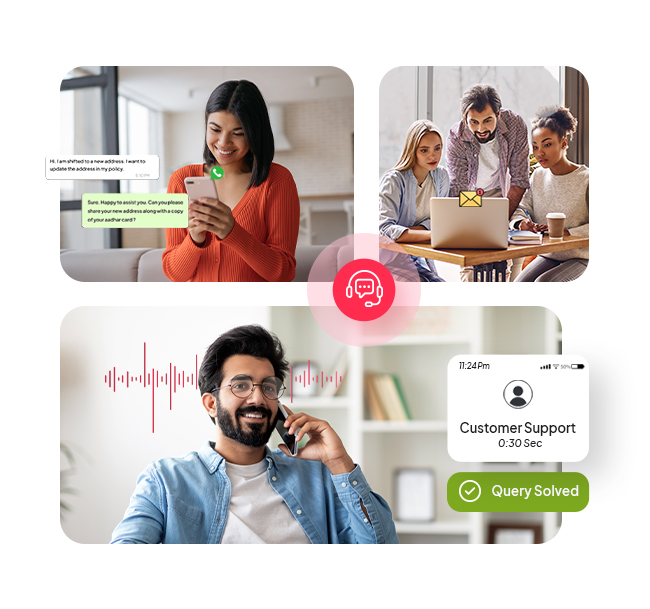

Conversational AI in banking refers to AI-based technology that can automate numerous time-consuming inbound and outbound banking communications and engagement processes. Introducing voice bots and chatbots at the right stages of company and contact center operations boosts efficiency, eliminates service line bottlenecks, and relieves employee stress.

FAQ bots can handle simple repetitive questions, increase agent availability for difficult situations by 50%, and reduce operational costs by 75%. Payment bots and RPA-enabled claims processing bots can help to digitize payments and claims processing. They save 60% on back-office costs and 80% on operating costs. You notice 10 times faster processing while effortlessly integrating them with CRM applications.

Benefits of Conversational AI for Banking

1. 24*7 availability-

One of the primary benefits of conversational AI in banking is its capacity to provide 24-hour client support. Customers can use conversational AI to receive answers to their questions, apply for loans, and even conduct transactions at any time of day or night. This is a big benefit for customers who are unable to visit the bank during normal business hours owing to work or personal obligations.

2. Personalization-

Another advantage of conversational AI for banking is the ability to provide each consumer with a personalized experience. By analysing consumer data, conversational AI in banking can deliver customized advice, recommend products and services, and provide bespoke solutions to fit each customer’s unique demands.

3. Faster Response Times-

Conversational AI in banking can respond to customer queries instantly, without the need for customers to wait in line or on hold for a customer service representative. This not only improves customer satisfaction but also increases the efficiency of the bank’s customer service operations.

4. Improved Customer Engagement-

AI chatbots and voice bots can engage customers in a more conversational and natural way, making it easier for customers to communicate their needs and preferences. This can lead to improved customer engagement, loyalty, and retention.

5. Cost Savings-

Implementing conversational AI platforms can also lead to significant cost savings for banks. By automating routine tasks and queries, banks can reduce the need for human customer service representatives, which can result in significant cost savings over time.

6. Fraud Prevention-

AI in the banking industry can also help prevent fraud by using machine learning algorithms to detect suspicious behaviour and transactions. This can help banks identify and prevent fraudulent activity before it causes significant financial losses.

Conversational Banking Use Cases

1. Loan assistance

AI chatbots and voicebots act as conversational agents and imitate banking staff in providing round-the-clock assistance to users. In addition to this, AI bots generate reports having details regarding customers’ credibility. Human agents can easily analyze these reports to find potential clients suitable for different types of loans. This helps in augmenting the agent’s performance.

2. Debt Recovery

One of the major challenges faced by banking institutions is the low collection efficiency rate. Timely sending reminders, understanding the reason for non- [payment, and then creating a customized repayment journey for the customers can help lending institutes in recovering the loan amount on time. Smart use of conversational ai and analytics in banking can eventually help banks in managing delinquency and reduce write-offs and settlement cases.

3. Financial Advisory

Conversational AI in banking provides personalised solutions and advice to customers for improving customer engagement with the company.

Chatbots and voicebots can communicate with customers to understand

- The return they are expecting while investing in a particular stock

- What is their risk appetite and how much maximum risk they can take

- What is the return their current portfolio is generating

Also, AI tools can send mass messages to customers regarding updated news, trending stocks, etc.

4. Customer Onboarding

AI bots collect necessary data for the onboarding and can initiate on-call registration of the customer. By providing digitalised onboarding services and guidance, you can have multifold digital adoption among your customers. This creates a self-serve platform for them where they can get 24*7 FAQs and query resolution, with timely reminders to avoid late payment fees.

5. Automated Customer Services-

Automated and quick replies to generic questions is one of the most useful applications of AI in banking bots. This not only improves customer satisfaction but also enhances the efficiency of your company. Only a few calls are transferred to the agents for resolution. This increases the company’s operational efficiency and the agent’s working efficiency simultaneously

Resolution to queries regarding account balance, account information update, money transfer, credit cards, loans, and EMI can be easily provided to customers through our intelligent AI bots

6. Personalized Notifications-

The needs and requirements of every customer are different. Some are interested in knowing the home loan rate of interest while others are interested in opening FD with your bank. Here, personalization comes into play. Personalized notifications in coherence with the client’s interests can help in gaining client trust and loyalty. This in turn is a long-term benefit for your company.

Conclusion

Conversational AI and automation is the future of banking. By providing 24/7 availability, personalization, faster response times, improved customer engagement, cost savings, and fraud prevention, AI in banking can revolutionize the way customers interact with banks. As the technology continues to evolve, we can expect to see more and more banks adopting conversational AI solutions to improve their customer service operations and enhance the customer experience. Request a Demo Today- Contact Us

Frequently Asked Questions (FAQs)

Frequently Asked Questions (FAQs)

Take the leap towards innovation with Rezo.ai

Get started now