What is Digital Debt Collection & Its Advantages

What is Digital Debt Collection & Its Advantages

We all know how fussy it is to get money from people, even when it is yours. Debt collection is never easy; it is even more tiresome with daunting manual procedures and cumbersome documentation. However, with the advent of technology, debt collection can be digitized and made more convenient. With Rezo’s Collection product, digital debt collection is now considerably more effective and efficient. It has completely changed the way that debt is collected.

What is Digital Debt Collection?

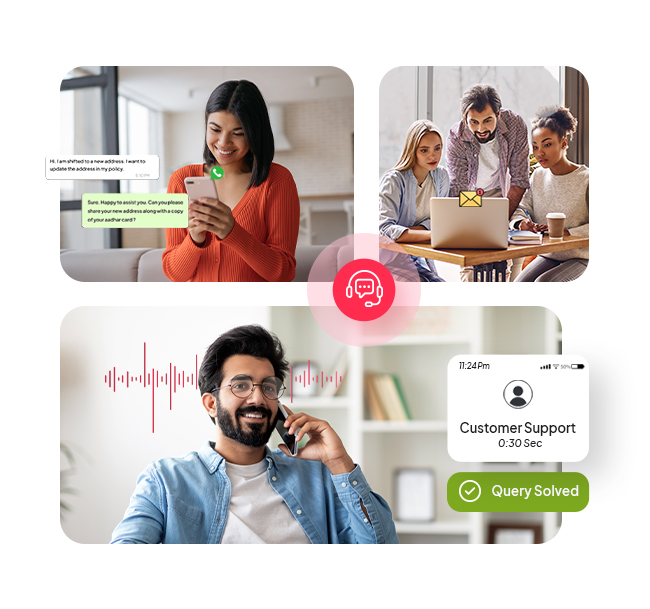

Digital debt collection is the process of contacting and engaging with debtors using digital channels and technologies such as voice calls, text messaging, and email. The goal of digital debt collection is to improve the efficiency and effectiveness of debt collection by leveraging technology to automate certain tasks and increase the likelihood of successful debt recovery.

Scope of Digitalisation with Rezo’s Collection Product

Bots for contacting customers: Rezo’s debt collection product uses digital tools like voice bots and chatbots to communicate with consumers. The AI-enabled bots use advanced Machine Learning and Natural language processing algorithms to interpret and respond to consumer concerns.

The technology of Rezo: Rezo’s digital debt collection product comes with the technology of auto-engage and auto-analyze. It streamlines and automates the process of contacting debtors and analyzing data to develop a suitable approach to avoid defaults and delinquency.

Increase effectiveness with dashboards: Rezo provides a debt collection dashboard that consolidates the data of debtors and divides them into suitable categories or buckets. It helps in better analysis of patterns in the data.

Also Check: Rezo’s Collection Product: A Better Way for Debt Recovery

What were we Missing Out on in Traditional Collection Wways?

The traditional method of debt collection is not the right choice in today’s modern times. Modern problems require modern solutions. Traditional debt collection processes typically require a lot of manual effort, which can be time-consuming and costly. Debt collectors must manually track and document their customer interactions, which can slow down the process and lead to errors. This is why organizations need to embrace the modern digital means of debt recovery.

Today all organizations have a mobile application and online platform that you can use to avoid standing in queues for hours. People sometimes show a little reluctance to adopt the technology. There can be diverse reasons behind this lack of engagement, such as

- Not everyone is tech-savvy. People don’t know how to use technology.

- Others still prefer conventional methods because they are unaware of the salient features and benefits of the digital banking app.

Digital Debt collection with the use of software is considered to be more transparent for both debt collectors and customers. On the other hand, traditional collection processes usually miss out on valuable insights that could help them improve their processes and outcomes. They were daunting and required a lot of manual interventions, and manual processes are more prone to errors. This led to inaccurate records, misunderstandings, and delays in the debt collection process.

Advantages of Rezo’s Collection Product over Traditional Ways of debt collection

Why do we need to go Digital for Debt Collection?

Digital adoption is important in debt collection because it streamlines the process, making it more efficient and effective. With debt collection software, traditional customers who may be used to manual processes can benefit from the ease and convenience of a digital platform. Digital Debt collection software eliminates the need for manual data entry. By automating the process, debt collection software reduces the time and effort required to collect debts.

Debt collection software also gives debt collectors real-time insights into the debt collection process. This enables debt collectors to track their progress, identify trends, and make informed decisions about their debt collection strategy. This real-time data is especially valuable for traditional customers who may be used to a more manual approach, as it provides them with a level of transparency and visibility into the debt collection process that was not previously available.

Know more about Rezo’s Collection Product

The collection product is a tool that automates the debt collection process. It provides a centralized platform for debt collectors to manage and track all aspects of the debt collection process, from tracking delinquent accounts to managing payment plans.

Benefits of Debt Collection Software of Rezo

Digital adoption in debt collection can bring significant benefits for debt collectors, debtors, and the broader economy by improving the efficiency and effectiveness of debt recovery.

- Efficiency: With Rezo’s Collection tool, debt collection agents can automate many of their processes, such as sending reminders, issuing invoices, and tracking payments. This can save time and reduce the workload of debt collectors, enabling them to focus on more complex cases.

- Improved communication: Digital adoption enables debt collectors to communicate with debtors in real-time through various channels, including email and text messages. This can improve the speed and effectiveness of communication, leading to faster resolution of outstanding debts.

- Increased transparency: The collection product enables debt collectors to provide debtors with real-time updates on their outstanding debts, including payment history, interest, and fees. This can increase transparency and trust between the parties, leading to faster and more successful debt recovery.

- Better customer experience: The debt collection dashboard enables debt collectors to provide debtors with personalized and convenient payment options, such as online payment portals, mobile payment apps, and automatic payment plans. This improves the customer experience and increases the likelihood of successful debt recovery.

- Reduced manual labor: Rezo helps institutions reduce operational costs by automating many processes, reducing manual labor, and improving efficiency. This can further lead to an increase in their profitability.

- Better strategies: The AI enabled debt collection agent by Rezo is equipped with machine learning and artificial intelligence. It recognizes and analyzes the pattern of the customer through his chats and other communications. After analysis, it suggests the best suitable strategy to increase the possibility of debt repayment.

Conclusion

The digitalization of debt grouping with Rezo’s Collection Product offers many advantages over traditional manual processes. By automating many of the processes involved in debt collection, the tool saves time, reduces manual labor, and improves efficiency. It also provides better communication, increased transparency, and customer experience. Additionally, using AI and machine learning in the tool enables debt collectors to develop better strategies for debt recovery. Rezo’s digital debt collection product is a valuable tool for debt collectors, debtors, and institutions seeking to improve their debt recovery processes.

Request a Demo Today- Contact Us

Frequently Asked Questions (FAQs)

Take the leap towards innovation with Rezo.ai

Get started now